UPI programs Let the exchange of dollars you start with just one bank account then onto the next immediately employing one’s mobile. Transactions might be reached through the app about the mobile since it had been. To utilize UPI, you need to possess a bank account with part financial institution, i.e., your financial institution ought to allow you to utilize the UPI workplace. A portion of the portion banking comprises their state Bank of India (SBI), HDFC lender, and ICICI Bank.

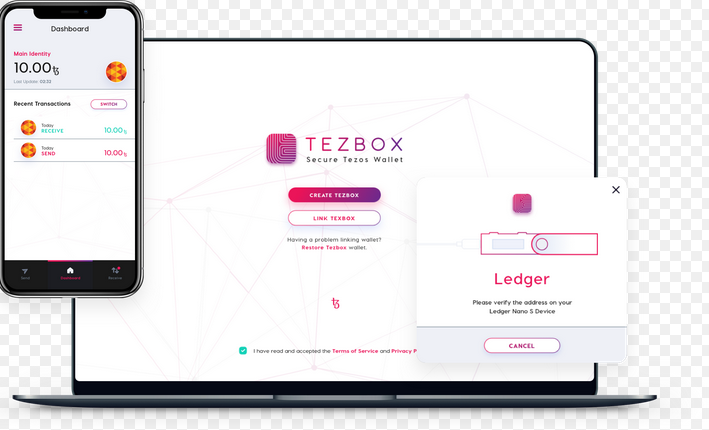

If You Have checked if your bank upholds UPI trade, you want to get into the UPI confirming application onto your cell phone. A portion of the typically utilized applications offering setup by Way of UPI programs like Paytm, PhonePe, Google Pay, Amazon Pay, tezbox restore wallet and so on. This commercial is preferred by most people due to the fact that is safe as it regards the specialized integration that was released shortly. Remember your portable number should be entrusted along with your own bank reflect the reason behind affirmation.

Action by step Instructions to set up UPI

If You Have downloaded that the picked UPI program, in there you will be necessary to decide on the financial institution in the offered selections. To verify that it is your banking accounts, your lender will ship you some one time secret key (OTP). Whenever the OTP is supported, the digital setup handle (VPA) is likely to soon be automatically made.

Here’s the Way by that you are able to set up a UPI accounts:

Stage 1: Download and set up the application in Google Play Retail Store or Apple App Shop.

Period 2: Decide on your favoured language.

Period 3: Pick the SIM which gets your mobile number enrolled with your own bank account.

Period 4: Set-up a four-digit password. You need to enter this four-digit top secret key to get to your application form.

Phase 5: Pick out your banking accounts. Set your UPI PIN giving past 6 digits and expiry day of the check card.